Prop B 7% Penalty

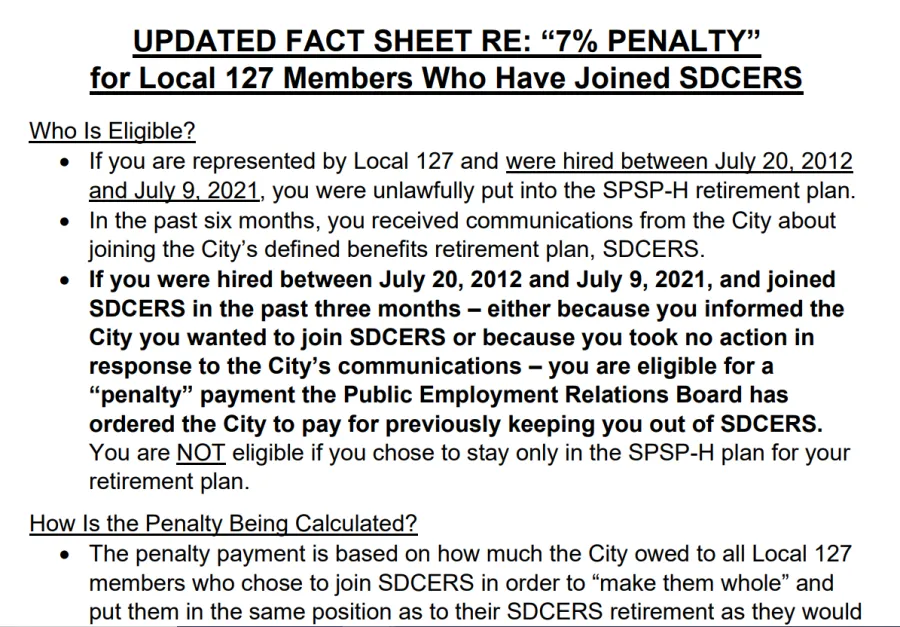

UPDATED FACT SHEET RE:

“7% PENALTY” for Local 127 Members

[by Hannah Weinstein]

Who Have Joined SDCERS Who Is Eligible?

• If you are represented by Local 127 and were hired between July 20, 2012 and July 9, 2021, you were unlawfully put into the SPSP-H retirement plan.

• In the past six months, you received communications from the City about joining the City’s defined benefits retirement plan, SDCERS.

• If you were hired between July 20, 2012 and July 9, 2021, and joined SDCERS in the past three months – either because you informed the City you wanted to join SDCERS or because you took no action in response to the City’s communications – you are eligible for a “penalty” payment the Public Employment Relations Board has ordered the City to pay for previously keeping you out of SDCERS. You are NOT eligible if you chose to stay only in the SPSP-H plan for your retirement plan.

How Is the Penalty Being Calculated?

• The penalty payment is based on how much the City owed to all Local 127 members who chose to join SDCERS in order to “make them whole” and put them in the same position as to their SDCERS retirement as they would have been in if the City had never placed them in SPSP-H. That number was divided by the total number of years all Local 127 members who chose to join SDCERS were unlawfully excluded from SDCERS. This calculation comes out to each Local 127 member who has joined SDCERS being owed $1,024.98 for each year they were in SPSP-H rather than SDCERS.

o The calculation will be done down to the day, based on when an employee was hired into a benefits-eligible position through the day they were able to join SDCERS.

• If you are eligible for the penalty payment, you will receive an email from the City soon about the exact penalty amount you will be paid.

When Will You Receive the Payment?

• Your penalty payment will be included on your September 30, 2022 paycheck, under the line item “Prop B Penalty.”

• The payment will be taxed in the manner your normal wages are.